The Task Force on Climate-Related Financial Disclosures

Foundation for Action

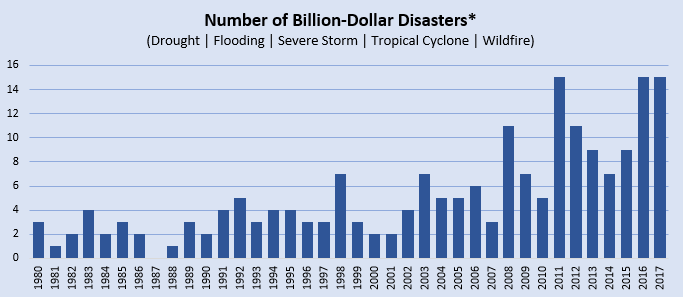

According to data collected by the National Oceanic and Atmospheric Administration (NOAA) National Centers for Environmental Information, between 1980 and 1989, the United States endured twenty-one weather and climate disasters with at least $1 billion in damages. In 2017 alone, the United States suffered fifteen weather and climate disasters with at least $1 billion in damages, including one drought, two major flooding events, eight severe storms, three tropical cyclones, and one wildfire event. Direct and indirect climate impacts—the increasing frequency of extreme weather events, market shifts resulting from legal and regulatory policy changes, shareholder demand for climate risk identification and transparency, and rising global temperatures and sea levels—all pose strategic risks and opportunities to businesses. Businesses that understand the risks climate change poses to their operations, value chain, reputation, and the communities they serve can seize the opportunity to become leaders in managing these risks and driving economic and market innovation.

*Adapted from NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2018). https://www.ncdc.noaa.gov/billions/

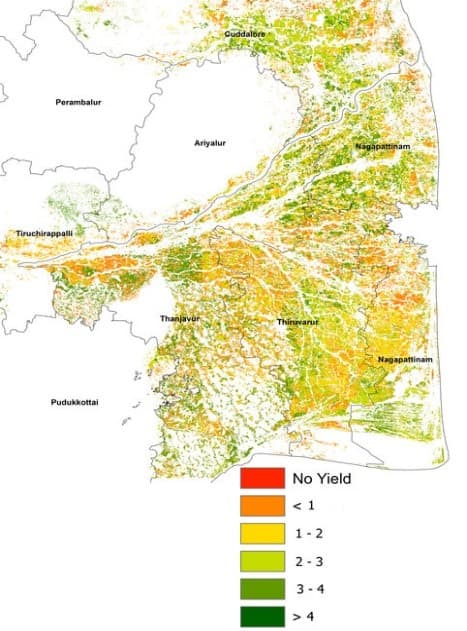

For example, Allianz Global Reinsurance (Allianz Re), a major agriculture reinsurer specializing in crop, livestock, aquaculture, and forestry reinsurance, has aligned its business response to climate change by identifying climate risks to its value chain and taking action to enhance its capacity to adapt. One such significant climate-related financial risk is the increased frequency and intensity of natural disasters due to climate change lead to risks to Allianz Re’s value chain due to crop yield losses, which can endanger the credit worthiness of Allianz Re clients and harm the communities that rely upon those crop yields for financial survival. Allianz Re has responded through a data-driven strategy to provide security for Asian rice farmers, who produce more than ninety percent of the global rice supply. The effort, Remote sensing-based Information and Insurance for Crops in Emerging economies (RIICE), is a partnership with governments and nongovernmental organizations to provide better information on rice crop growth through remote-sensing technology to increase the accuracy of Allianz Re’s underwriting and to help farmers secure their crop and earnings.

Vail Resorts is also a leader in adapting to climate-related financial risks and opportunities. Rising global temperatures and reductions in snowfall amount and consistency negatively impact an outdoor winter recreation industry that is heavily reliant upon weather conditions. In the 2014 ski season, for example, the Sierra snowpack water content fell to a record low five percent of average, leading to very poor ski conditions at Vail Resort’s Tahoe-based properties. Vail Resorts identified the risk posed by changing climate conditions to the companies’ financial security and the community surrounding its properties, which rely upon tourism to drive economic development and local business. To address the risks associated with changing climate conditions, Vail Resorts has diversified its portfolio to include resorts in locations that are less vulnerable to poor snow conditions, such as acquiring Whistler Blackcomb in Canada in 2016. Vail Resorts is also launching summer activities to drive business during the off-season.

Cadmus works with businesses and communities at all stages of the process of understanding, assessing, and managing climate-related financial risks and opportunities. In addition, we have a deep commitment to mitigating the impacts of our own operations on climate change and preparing for a variety of climate-related risks to our own mission—making us the ideal partner to help you identify and address your company’s climate related risks and opportunities, understand the implications of shareholders’ expectations regarding climate-related disclosures, and align your company’s climate-related financial disclosures with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. We can also guide your company through an interactive scenario analysis and planning process that illustrates the range of potential climate risks and opportunities to your business assets.